Bill Wood

PLASTICS NEWS ECONOMICS EDITOR

Published: September 22, 2014 2:13 pm ET

Updated: September 22, 2014 2:17 pm ET

Summer is nearly over. That always-too-short vacation on the beach is a fading memory. The kids are back in school, and now is the time of year that intrepid economists and other market prognosticators start to publicize their forecasts for the new year.

That’s right, I said the new year.

Even though we don’t yet really know what the final economic data will look like in the second half of 2014, we are already trying to look ahead to the end of 2015.

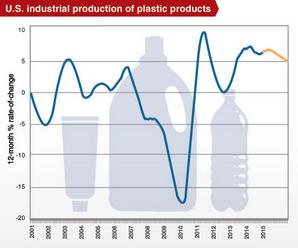

During the next few weeks I will be extending my own forecasts for the major economic indicators and critical plastics industry end-markets through 2015. And to kick-off this new forecasting season, let’s take a look at the best indicator I know for gauging the vitality and prospects for the U.S. plastics industry —the industrial production index of plastics products. This data series measures the monthly output of plastics products in the U.S. It is compiled by the Federal Reserve Board, and it is released near the middle of every month in the form of an index.

This index of the industrial production of the plastics industry is just one of hundreds that the Fed compiles, calculates and reports. All of this data, much of which is pertinent to plastics processors can be found online.

For the purposes of this analysis, I have downloaded the monthly data for plastics into a spreadsheet and calculated the 12-month rate of change. A rate of change chart is useful in the forecasting process because it will smooth-out the fluctuations and noise in the data that can be caused by seasonality or other non-market related events. What is measured on this chart is the rate of growth, or the momentum, in the data over the period of the past twelve months. If the graph is above the 0-line, then in indicates that the industry grew by that amount during the previous twelve months.

As this chart indicates, the output levels of the plastics industry have enjoyed positive growth for the past five years, and since 2012 the growth rate has been in the range of 5 to 6 percent per year. The graph clearly shows an acceleration in the rate of growth during the past three months, which suggests that the industry will enjoy strong demand for the rest of this year and into 2015.

After expanding by 6.1 percent in 2013, our latest forecast calls for an increase of 6.3 percent in 2014 followed by a gain of 5 percent in 2015. The pace of growth we have enjoyed for the past three years is reminiscent of the rate of expansion that the industry enjoyed throughout much of the 1990’s, and it is significantly faster than the average rate of growth that occurred in the 2000’s (2001-2010).

Image By: Jessica Jordan

So that’s the good news — the industry is expanding at a strong rate, and it appears poised to sustain this momentum through at least the end of 2015. The bad news is that the total output of the U.S. plastics industry is still not back to its peak level. According to the Fed’s data, total output of plastics products in this country hit its all-time high in 2006. The index value for the data at that time was 106.0. Production levels then declined sharply for the next four years, culminating in a record-breaking drop of 17 percent in 2009.

The most recent index value is 98.9. So if our forecast is correct, the industry will finally get back to its pre-recession peak of 106.0 late next year. That is a span of more than nine long years since its last cyclical high-point. I have a big cigar in the humidor and some expensive champagne in the refrigerator just waiting for the month that we finally get back above the pre-recession peak.

I promise I will let you know the moment I break them out.

In the meantime, I encourage you to monitor closely the rate of expansion in the overall industry, and make sure you compare it to data from your own company and crucial end-markets. The momentum in the market will have a substantial impact on your profit levels and investment decisions. Rate of change analysis is particularly handy because you can compare two or more series that are measured in different units (pounds, square feet, units, dollars, etc.) all on one chart with a single scale.

For instance, if you take a monthly data series from your own company (i.e. monthly sales totals), you can calculate a 12-month rate of change and compare it to the chart provided here. If your line is above the industry line, then you are growing faster than the overall industry. If your line is below the industry line, then you are growing slower.

Now I know that there is a learning curve to this type of analysis, and your time is already overbooked just keeping up with the other demands of your job. But hey … isn’t that the nature of manufacturing? It is very, very competitive. In order to succeed you have to look forward, calculate the probabilities, assess the risk and place your bets on an outcome.

In other words, you have to invest if you want to stay viable for the long run. You have to invest your money and you have to invest your time. Your competitors are doing it and so are your customers. But the fact that it is inevitable does not mean that it is not difficult. There is a lot at stake. In the long run, you don’t have to get it exactly right every time, but you cannot ignore it completely. And the really good news right at this moment in time is that virtually all of my charts and graphs show that those businesses that have aggressively invested during the past three years are reaping large returns.

Fortunately, you have at least two things going for you that will continue to shift the odds in your favor. The first is that you love to compete. You must love it or you would not have chosen a career in manufacturing plastics products. You thrive on the pressure, and you savor the thrill of success.

The other thing you have is a steady and reliable flow of information and data about a large and active market for plastics products. And as the market becomes more competitive, it raises the value of good market information.

So if will you do your part by remembering that the kids are not the only ones who can benefit from getting back to the books, we will continue to do our part of analyzing and reporting the latest and most useful plastics industry and economic data.

Bill Wood is Plastics News' economics editor.

|